The Seed Round Myth: What Ahmed Ahmed Thinks Founders Get Wrong About Raising

An active early-stage investor outlines how signaling, positioning, and judgment shape outcomes long before metrics catch up

Published Feb. 7 2026, 3:00 p.m. ET

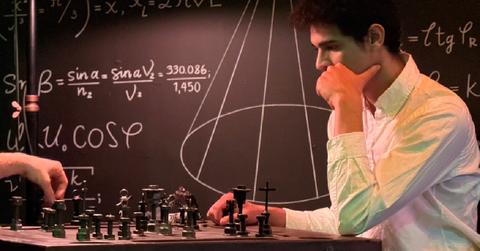

Every seed round has two sides. Ahmed Ahmed has lived both. He has been the one trying to keep a scientific project alive long enough to prove it works. He has also been the one deciding which founders get the first real check and which ones get told to come back later. He does not romanticize either side.

He talks about fundraising with the tone of someone who thinks accuracy matters more than comfort. “The more I watched early stage rounds happen, the more obvious it became that the best company does not always win,” he says.

He names one dynamic that founders tend to underestimate. Positioning. That word can sound like marketing. He uses it as a structural reality. A company can be strong and still be invisible if the story is unclear, if the category is confusing, or if the founder cannot connect the technical work to an outcome that an investor can evaluate.

“Founders think the product is the pitch,” Ahmed says. “The product matters, but the decision gets made through a thinner lens at seed. You have to earn attention first.”

He is direct about what sits inside that lens. Social proof. Signaling. Backchannels. The parts of the system people rarely talk about in public, even though they shape who gets meetings, who gets terms, and who gets left out.

He has said that investor signaling and backchanneling can dramatically affect valuation and access, even when the underlying company is the same. That point lands because it is not theoretical. Founders feel it. Investors see it. Most people pretend it is not there.

“Seed is not a science fair,” he says. “It is a bet on trajectory.”

Ahmed frames this as a reason to get clearer, not louder. He does not advise founders to inflate claims. He advises them to translate. A technical team has to make the work legible without flattening it into buzzwords.

Many founders try to solve that problem by talking faster. They cram in features, roadmaps, and big market numbers. They talk like certainty is the goal. Ahmed pushes back on that style.

“I do not need performance,” he says. “I need clarity. I need to understand what you are building, why it matters, and how you will learn fast without lying to yourself.”

He also believes founders misunderstand what investors optimize for. Many assume seed investors are looking for moats first. Ahmed argues that seed decisions often hinge on whether the founder is the person to make this a reality.

He describes the evaluation in practical terms. What does the founder do when something breaks? How do they react when early users behave differently than expected? How do they decide what to ignore? How do they define success beyond vanity metrics?

“Early stage is a decision making test,” Ahmed says. “The company changes every week. The question is whether the founder can keep making good calls while the ground moves.”

That focus explains how he approaches early investments. He is active in the Y Combinator ecosystem and has said he routinely invests in a meaningful share of each batch. Those environments reward speed. They also reward pattern recognition.

"Moving fast doesn't mean lowering your standards; it means removing the friction that has nothing to do with the decision. If you know what a good founder looks like, there's no reason to wait three weeks to say yes. The calendar is a real constraint, so we treat speed as a default."

He believes the strongest founders do something that looks almost boring from the outside. They build trust through consistency. They show their work and keep their story aligned with reality. They do not treat fundraising like a popularity contest, even though it sometimes behaves like one.

That stance matters for another reason. Many early-stage founders face a quiet disadvantage when their work is too technical for the average gatekeeper. Ahmed has said he hated watching deep tech teams struggle because junior VC analysts could not understand what the companies actually did. He also has said his fund does not dismiss a company due to ignorance.

Founders feel the downstream effects of that gap. They get filtered out before they get a chance to be understood. Ahmed treats that as a fixable failure in the system.

“Serious work deserves serious effort,” he says. “If I cannot understand it, that is on me to learn, not on the founder to simplify it into nonsense.”

He also has a disciplined view of what seed money should be for. He does not want founders using capital to buy time without learning. He wants capital to compress the path to truth.

“The check is not a prize,” Ahmed says. “It is fuel for validation. The goal is to turn uncertainty into evidence.”

This is where his thinking on positioning gets sharper. He does not tell founders to ignore signaling. He tells them to build it the right way. Real signaling comes from credible operators backing you. It comes from a coherent story that survives scrutiny. It comes from a product that creates behavior change, not just interest.

He also believes founders should be more intentional about references. The backchannel is going to happen whether a founder likes it or not. A founder who ignores that reality is leaving outcomes to chance.

“People will ask who you are when you are not in the room,” he says. “You should know what they will hear.”

Ahmed’s own preference is not to be known as a loudspeaker. He has said he wants to be positioned as someone trusted for judgment, not promotion. That line is a constraint. It shapes how he shows up with founders. It also shapes what he wants founders to do.

He wants them to communicate with precision. He wants them to respect the difference between confidence and credibility. He wants them to stop assuming that a strong product will automatically win. He has watched too many good teams get stuck because the world never understood what they built.

“Build something impressive and communicate that, the market will catch on.” Ahmed says.

For more information about Ahmed Ahmed, visit his LinkedIn and Wefunder profile.