12 "Meme Stocks" That WallStreetBets Pumped up to Get Back at Hedge Funds

Updated Feb. 2 2021, 11:20 a.m. ET

One of the most inspiring acts of collective civil disobedience that have occurred in recent weeks is WallStreetBets' decimation of hedge funds by beating these businesses at their own game. It's a dirty open secret that market manipulation occurs every single day on the stock market, especially when it comes to long and short selling company shares.

Massive financial institutions have so much capital that they're able to use this money in order to value or de-value companies and then make a killing on "betting" whether or not a company's valuation will rise or fall. In some instances, insider trading is even used in order to turn a profit, like when Senators and members of Congress used their knowledge of the COVID-19 pandemic to offload stocks with companies who would be affected by said pandemic.

There are also reports that these same politicians used their knowledge of "the new normal" in order to invest in corporations that would more than likely thrive in an entirely different human environment.

Manipulating the value of stocks however is another game entirely, and it's one that a group of Redditors decided to win when they discovered a bunch of companies suffering an impending doom, like GameStop, where being shorted by hedge funds betting on their loss.

A large group of folks with individually modest amounts of capital pooled together their resources to pump up the value of these stocks by "over" buying them. And companies that have either been hemorrhaging money for years or were adversely affected by the pandemic are now seeing huge leaps in stock valuations. The following businesses are ones that WallStreetBets either made a killing off of or precipitated Robinhood in limiting the number of shares any single person could possess.

While many folks cried foul at the app's restrictions, including notable politicians with usually diametrically opposed views like Alexandra Ocasio-Cortez and Ted Cruz, Robinhood reportedly "caved" into pressure from Wall Street financiers and helped curb their losses at the hands of the little guy. Share buying in many of these companies have been restricted as a result.

BlackBerry

It's crazy to think that there was a time when BlackBerry pretty much dominated the mobile phone landscape and continued to do so even after the first couple of iPhones were introduced into the market. What really put the nail in the coffin for the Canadian cell phone manufacturer was its ill-fated Storm smartphone which became functionally unusable because BB opted to put less RAM into the device.

What emerged was one of Verizon's hottest selling smartphones with some of the worst customer satisfaction ratings. Ever since the Storm's failure, the company's market share decreased and decreased, was eventually eclipsed by Android, and tried to rally back by adopting Google's OS. While Blackberry still exists, it's focused less on manufacturing cell phones and more on software development.

Regardless, WSB managed to help boost the company's share values around 150%: it's 52-week low was $2.70 and its high was $28.77.

Koss

When you think of headphone manufacturers, Bose, Sony, Beats by Dre, JBL, Jabra all probably pop up in your mind. And while KOSS has been known to make some well-received headphones that audiophiles everywhere will identify at a glance (like the Porta Pro) it's not like people are putting Koss headphones on their Christmas wishlists.

Put WallStreetBets helped influence a crazy jump in stock valuation. Throughout all of 2020, Koss stocks were basically valued at $2 each, but fell as low as .80 cents a stock, but then shares hit a 52 week high of $127.45. As of this writing, Koss is still enjoying a respectable $34 share price.

Trivago

The trip booking service (comparable to Priceline and Expedia) experienced significant losses in the wake of the COVID-19 pandemic as travel was severely inhibited due to...you know...our entire planet gripped in fear from contracting a disease there was no known cure for.

But WallStreetBets was able to pump up Trivago's stock significantly, jumping it from $2.10 on January 26, 2021 to $3.19 in a single day. Not bad.

AMC

Movie theaters were another casualty of the COVID-19 pandemic. Prior to WallStreetBets' smackdown of big hedge funds, AMC stock was only 4.96 a share on the 26th. They then jumped to $19.90 apiece, nearly quadrupling the investments of everyone who dumped their funds into it and got out at the right time.

GameStop

The stock that's "defined" this movement against hedge funds, GameStop Corp.'s downfall has been occurring for quite some time. From business practices that were infuriating from a customers' viewpoint (paltry sums offered for trade-ins, constant up-selling of Power Up cards and subscription packages) the retailer's been suffering for years.

This became even more apparent with more and more users downloading games onto their consoles instead of heading to the store to buy physical copies of the discs. Plus, it didn't help that GameStop stores aren't known for being exactly sleek and modern-looking, with throngs of empty boxes jammed into every nook and cranny of the store.

In the past year, GameStop was only $2.57 a share at its lowest. And it's highest? $483.00. Nice work Reddit.

Bed, Bath & Beyond

Bed, Bath & Beyond was known for having some of the most generous return policies ever. That didn't help the retailer from experiencing significant losses. Things weren't looking pretty for the home goods retailer: it's 52-week low stock price was $3.43 and its high was $53.90. In fact, between January 25th-26th, there was over a $20 per share increase.

Nokia

Nokia was once a mighty mobile phone manufacturer known for crafting some indestructible feature phones. The Finnish manufacturer was also ahead of the game. Its Symbian s60 operating system as early as 2005, allowed mobile phone users to make video calls from their phones, access WiFi networks, use turn-by-turn voice-guided navigation, enjoy cloud storage, print wirelessly, use Bluetooth accessories and tons of other modern things we love doing with our smartphones.

The problem is, Symbian didn't really evolve with the times and instead of crafting an exciting new mobile OS as Apple did with the iPhone, they kept trying to rehash certain ideas and adapt Symbian to a touch interface...which didn't work so hot. Fan favorites like the Nokia N9 took way too long to be released, as well. The company's had a bit of a resurgence thanks to its foray into Android, but in the past year, its stock dipped to $2.34 a share (at its lowest). WSB brought it up to as high as $9.79, however.

Express

Fashion retailers are always rising and falling, and Express has experienced some hard times as of late, like many brick-and-mortar stores that have suffered throughout the pandemic. In the past year, the company's stocks dipped as long as .57 cents a share, but after Reddit's WallStreetBets rally, it reached a whopping $13.97 a share.

Genius Brands

This media company's sole focus is providing "purpose" driven content for children that focuses on morals, ethics, and addressing issues in kids that'll help them grow into empowered adults. Think the opposite of Peppa Pig and her family of miscreants that do nothing but snort, eat, play pranks on one another, and sleep all day, ugh that show is the worst.

While Genius brands may have a a "higher" calling, the media company's stock price was anything but high this past year: its 52 week low was 0.052, literally about a half a penny. That ballooned up to $11.73 at its most affluent.

Naked Brand Group.

The Naked Brand Group underwear company experienced a whopping surge in stock prices over the course of a year. At its lowest, the company was trading at an underwhelming 0.066 cents a share, and at its highest, Naked was all the way up to $3.40. Not bad.

Stocks weren't the only financial holdings that WallStreetBets pumped in order to turn the tides on Hedge Funds and make some money for themselves in the process, they also were able to boost the value of cryptos, too.

DogeCoin

If you want to talk "meme stocks" DogeCoin literally started as a joke from the infamous Shiba Inu "Doge" meme. The cryptocurrency has had a number of investors who've rallied behind it as of late, pumping up its value. The CryptoCurrency has seen a huge jump since January 27 from .0078 cents all the way to a staggering $.0716 cents. It has seemed to level off now at .03 cents, however, that's still a huge increase.

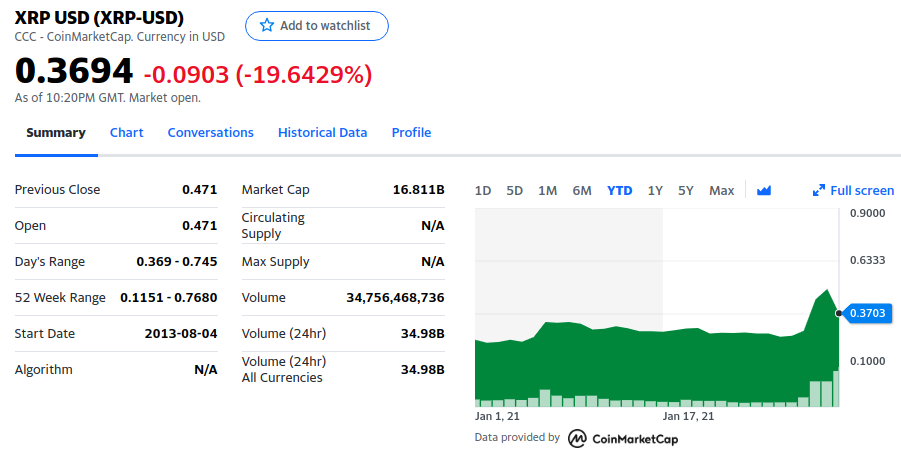

XRP

This cryptocurrency also saw huge jumps as well, from 0.1151 a coin to a whopping 0.7680 in a 52-week range. Redditors helped to contribute to the precipitous increase in the currency, pulling in huge multipliers for those who bought and sold at the right times.

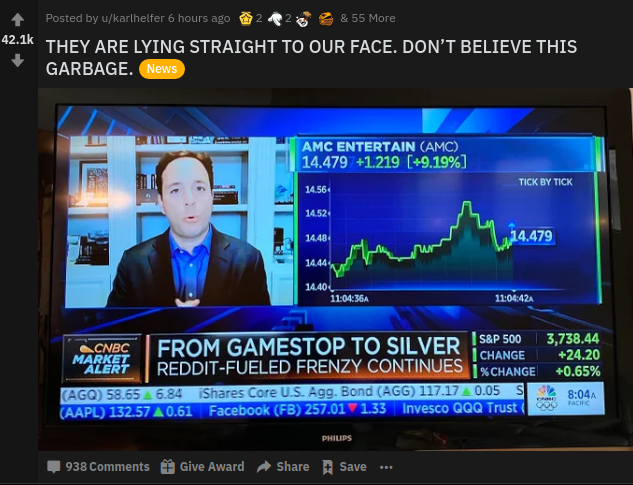

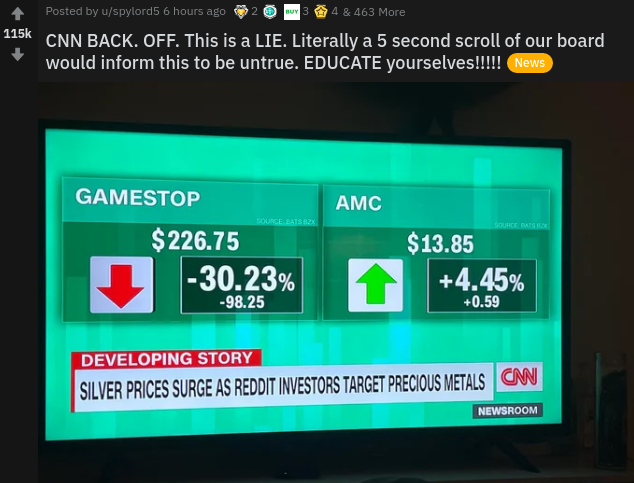

WallStreetBets say they're not behind the silver surge, FYI.

It's skullduggery at its finest, if you're to believe Redditors who are decrying all of the media "propaganda" that are trying to get people to purchase mass quantities of silver online.

WallStreetBets have maintained their position to "stick it" to hedge funds by holding onto their GameStop stock and several popular and verified users on the platform have shared photos decrying mainstream media outlets from either publishing misinformed articles or outright lies that Redditors are targeting silver, as many big hedge funds have long-sold precious metals.

It appears that the tear-inducing war between big-time hedge funds and "the little guy" has just begun and with more eyes than ever on the financial sector, more and more people are looking to make some money by getting in on the WallStreetBets fun.