“Banks Want Us in Debt” — Capital One Cut Woman’s Credit Card After Weekly Payments, She Says

"I pay them too much money and they closed my accounts."

Published May 12 2025, 9:56 a.m. ET

Have you ever paid off all your credit cards, only to see your credit score drop across the board? Experian writes that paying off one's debts will "eventually" boost one's credit valuation. However, there are throngs of people who have mentioned the correlation between wiping out debts and credit score precipitations.

One would think that the opposite should be the case; you're borrowing money from a lender, and you pay it back to them promptly. That's what TikToker Tiffany J Upton (@tiffanyjupton) said she's been doing with Capital One.

And the financial institution just canceled her credit card because of it, she claims.

In a viral TikTok that's accrued over 1.6 million views, Tiffany says that she not only lost out on her accounts, but also the points she accrued as a result of banking with the company. "Capital One closed my accounts and took my 100k travel points for paying my balance too many times," she said.

She posted about her experience with the bank in a series of videos, the first of which she appended with a caption that breaks down what she talks about in the clip. "The craziest thing that has ever happened. You try to be smart with your money, but Capital One clearly wants their customers to stay in debt. Do not bank with them bc they will s---w you over. "

Tiffany explains that she runs her own business and has been doing so for six years. Each week, she orders a specific number of products, which she would buy with her Capital One Venture card. After loading the card up with debt, she would "pay it off weekly" so she "could reuse it again."

She added that she also has her own personal account with Capital One that she pays off monthly, along with a "savings account" which contains "thousands of dollars."

Throughout the years, she's accrued over 100,000 travel points on the card, something she was saving for a "rainy day" in case she wanted to book flights and accommodations without having to spend money to do so.

Tiffany went on to state that she makes sure to pay off her Capital One Venture card either from the money she gets directly from her Square funds via her business or her personal account.

This is a weekly occurrence for her, as she's constantly paying her balance off. However, one week after paying off her balance, she received a notification from Capital One.

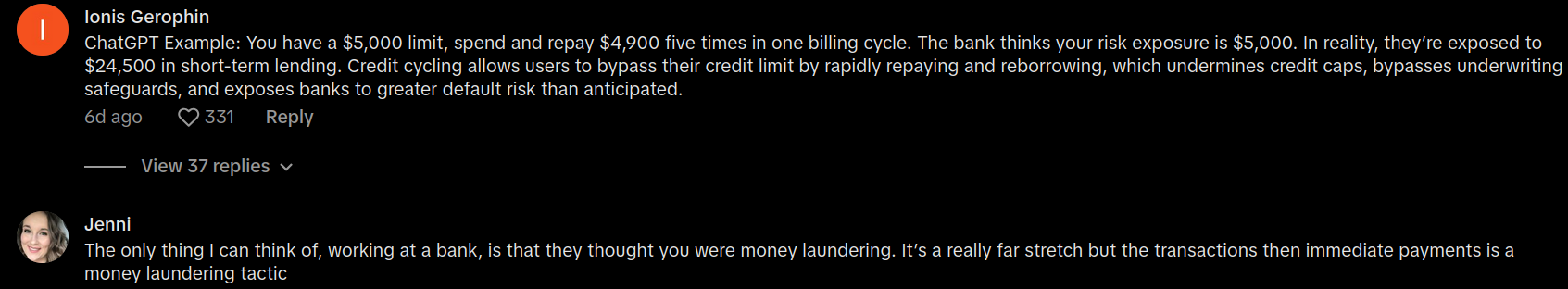

Tiffany was informed that her account was "restricted due to suspicious activity." Following that, she received a call from the bank's "fraud department" going over all of the transactions that she had made to pay off her balance.

After confirming all of these payments, she was told by a Capital One representative that further verification was needed to determine if she was indeed the owner of the personal bank account.

Tiffany says she was taken aback from the stipulation, but complied with their request. One of the non-Capital One banks she does business with was able to easily verify that she was indeed the account holder.

The other, however, is where Tiffany hit a snag. Capital One said that not only did they want to see her bank statements, but they wanted to see her "full account number" on her information sheet.

So they asked her to send a voided check from that bank, which she did. But the problem still wasn't solved, as Capital One said the number on the check didn't match the account number from which she was making payments. Tiffany said she was on the phone with multiple reps from Capital One for around three hours.

Tiffany said that of those cumulative three hours, she was put on hold for more than two-thirds of that time. At this point, Capital One said they had to get in touch with Square Bank to verify if she was indeed the account holder in charge of these funds.

So Tiffany ended up interacting with someone from Square, who provided an exhaustive list of documentation that proved she was indeed the account holder receiving these business payments. This paperwork had her name, address, account number information — everything that spelled out she was indeed the owner of the account paying off her Capital One balances.

In spite of all this, Tiffany says that she received notice from Capital One that all of her accounts were closed due to "suspicious activity" because they couldn't verify she was indeed the owner of the other bank account where she received her Square payments.

The business owner expressed her frustration at this consequence, especially because she says she provided all of the information Capital One requested. Furthermore, she not only had her money flow disrupted but also lost all of the travel points she had accrued with the financial institution in the process.

"I pay them too much money and they closed my accounts," she says towards the camera at the end of her video.

In a follow-up clip, she questioned whether or not it was worth fighting to regain her Capital One accounts, as she's already moved all of her funds elsewhere.

Numerous folks who replied to her second post said that she should, at the very least, try and get her points back as the bank effectively "stole" from her even though she didn't do anything wrong.

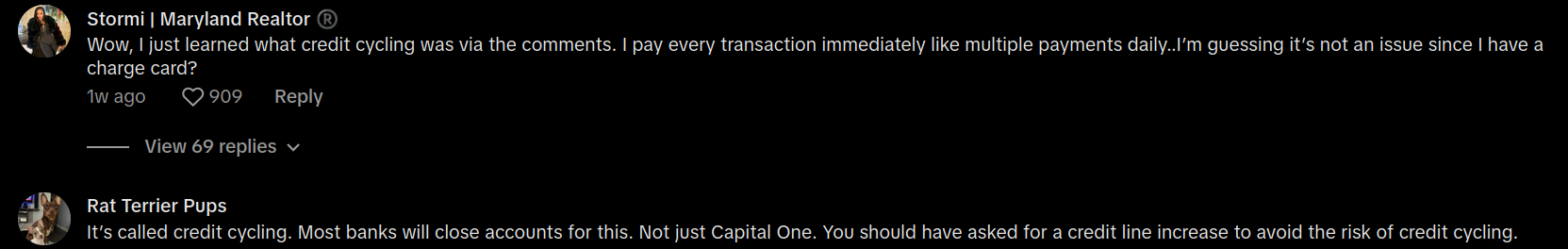

Others stated that the reason her account was closed was because she was "credit cycling."

Nerd Wallet describes the practice as maxing out a credit card and then paying it off to try and charge more to the credit card in the same cycle. Throngs of commenters replied to Tiffany's post, stating that she should have requested a larger spending limit on her card, and that would've fixed the problem.

Have you ever tried "credit cycling" and encountered any problems whilst doing so?