Man Shocked After Making Extra Student Loan Payment, Only to See Balance Jump Higher

"What am I doing wrong?"

Published Aug. 1 2025, 9:16 a.m. ET

A man was stunned after making an additional payment on his total student loan balance. TikTok user Rybo (@rabrba) said that two days later, the extra cash didn't make a dent, and he ended up owing even more money for his college loans than before.

He shared his shock in a viral TikTok that accrued over 1.6 million views on the popular social media application.

"Hi, I'm gonna lose my mind. I just paid my student loan bill, two days ago. And I noticed that my balance was this after paying my regular monthly payment." As he says this, he points to an on-screen text overlay that appears above his head. It reads $30,152.

Next, Rybo goes on to state, "Which I pay double what I'm supposed to, my minimum payment. And so I said hey, why don't I just pay the extra $153 to finally see under $30k?"

He goes on to state that he's had "the same balance for the 13 years that [he's] been paying the student loan."

This is why he decided to throw some more cash at the debt to see if it would change the grand total he's been accruing. "So I did. I submitted an extra little payment to the government. You're welcome. I was like this is gonna be so gratifying to see 29, finally," he told his viewers.

"And then I open my account this morning and I see this number." Despite giving a bit of extra cash, it turns out that his loan amount actually went up to $30,157.

He blinks and gives a mirthless smile to the camera, "I know it's interest. But I'll never see 29 will I? Will I?" he says at the end of the clip.

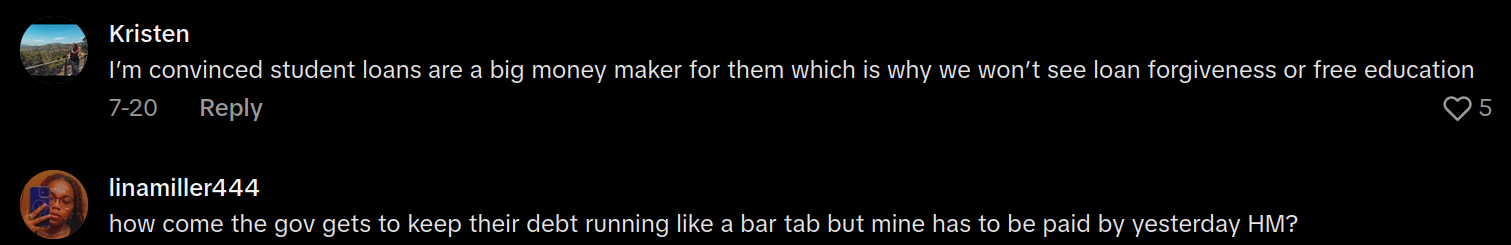

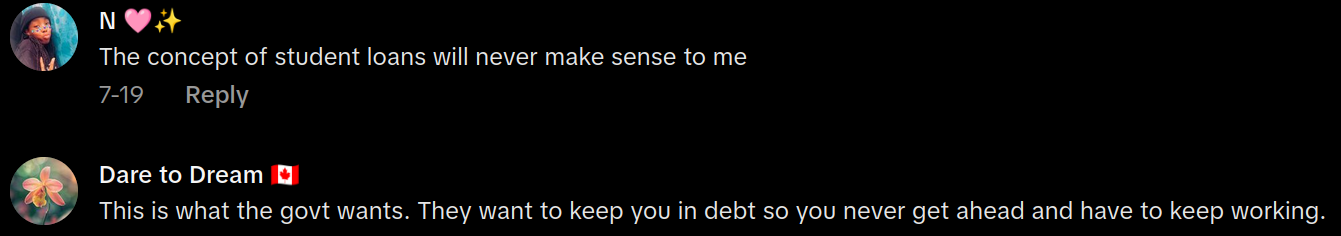

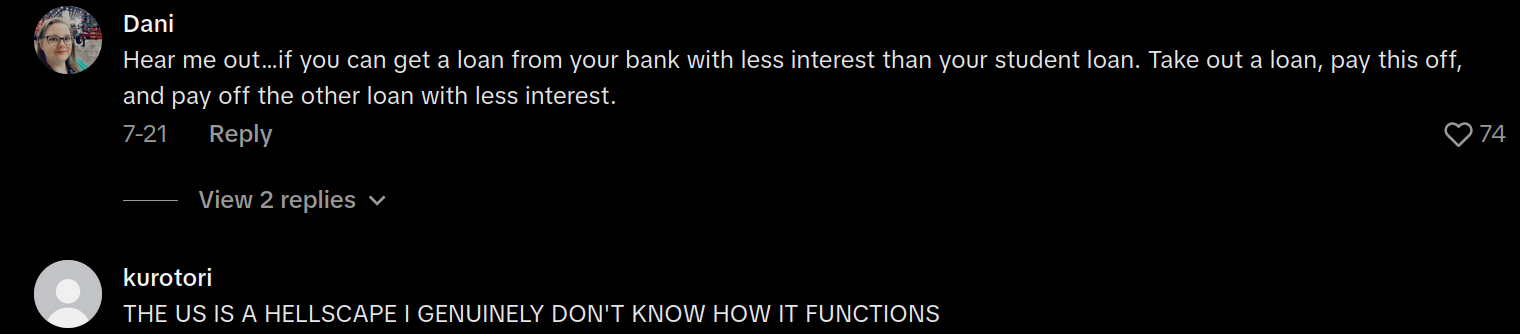

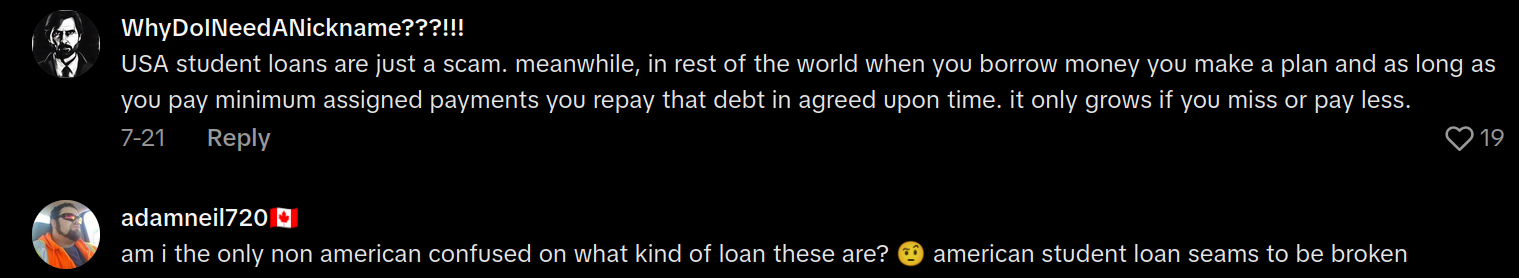

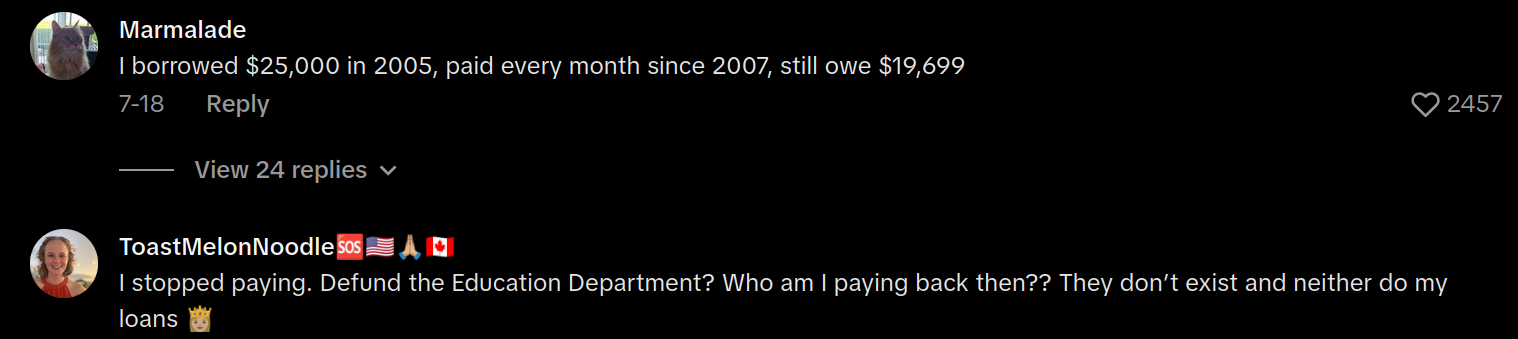

Numerous people who replied to Rybo's post stated that they are in a similar situation. One person on the application wrote that they had paid off their student loan more than two times over and were still well behind. "I borrowed $13k, have paid over $30k, and still owe $7k," they wrote.

Another user on the application wrote that they hadn't missed a student loan payment in 20 years and are still unable to expunge the debt. According to them, they've paid back what they borrowed three times over.

Furthermore, they shared that they're not asking for a zero-interest loan or lending without interest. However, they requested that Federal Student Loan lending rates aren't beholden to compound aggregates.

"I’m not asking to not pay. I’m not asking for zero interest. I’m asking for simple interest and not compound. Why can I pay off a $50k car in 7 years but still owe $19k on a $30k student loan and have never missed a payment in 20 years? I’ve paid it back 3x!" they wrote.

Another person replied that they, too, have been constantly paying off their student loans, only to see that their balance remained unchanged for years. "Paying double for 13 years and having the same balance is slavery," they remarked.

One person called out United States Government Officials for gladly taking money from taxes for PPP loans, while refusing to pass new legislation regarding student loan forgiveness.

"And members of Congress gladly took the free PPP loans while denying student loan forgiveness."

The total amount for US student loan debts has grown to a massively turgid amount, according to The College Investor. As of 2025, it stands at an unbelievable $1.76 trillion.

Much of this is more than likely due to compound interest rates, which have steadily increased throughout the years.

According to Finaid, the direct subsidized interest rate for Federal Student Loans increased to 6.39% in 2025, just under double the 3.4% it was between 2012 and 2013.

Direct Unsubsidized interest rate loan amounts have varied throughout the years, but as of this writing, are tantamount to their subsidized counterparts.

With so many people routinely making monthly payments on their student loans and still not seeing any change to their final total balance, it's understandable why so many are calling for reform in how student debts are being paid back.

SoFi bank explains that income-driven minimum student loan repayment plans are why many folks aren't seeing a change in their total balance. That's because these amounts aren't covering the compounding interest on their total balance.

Additionally, government-led initiatives and decision-making throughout the years have arguably contributed to the crisis at hand.

One such United States politician, former President and Vice President Joe Biden, advocated for legislation throughout his career that would facilitate the process for children to take out burdensome student loans along with their parents' co-signatures.

Some argue that these rulings were either performed out of ignorance or ill intention, as, like one TikToker put it, throngs of Americans have been subjected to indentured servitude to pay back a debt many can never recover from.

And while it's widely believed that Federal Student Loan repayments are unaffected by declaring bankruptcy, this isn't the case. There are actually laws that protect folks who may need to become bankrupt in order to set their finances straight, and they may not need to ever pay back their student loans.

However, to do so, the person filing for bankruptcy has to prove that paying these student loans back would ultimately cause them "undue hardship" by doing so.

It's no wonder that fewer and fewer people are attending college each year. The days of walking away from a University with a degree in hand and being guaranteed a well-paying job are effectively over and have been for a while.

Or you could just not get a college degree. There are tons of top companies, including Google, Apple, Facebook, and Microsoft, that don't care whether or not you attended a four-year university. So maybe just find an industry you want to work in and immediately start working in it as soon as possible.