What Is Polymarket: The Billion-Dollar Betting Startup That Blurred the Lines of Finance

If Reddit and Wall Street had a baby, it might look something like Polymarket.

Published Dec. 2 2025, 3:54 p.m. ET

A website where people bet money on real-life events — like elections, celebrity breakups, or the weather — might sound like something straight out of Reddit or Vegas. Polymarket, however, isn’t just some weird internet glitch. It’s a billion-dollar startup backed by Wall Street, Silicon Valley, and even Anthony Kiedis from Red Hot Chili Peppers.

If you’ve ever asked yourself what Polymarket is and why you keep seeing advertisements for it on TikTok, here’s the short answer: it’s a reality based prediction market. In this market, people place bets with real money on what they think will happen in various real world events.

More and more people want to understand what Polymarket is and how they can use it.

At its core, Polymarket lets you buy and sell “shares” in the outcomes of future events. Will Bitcoin hit a new all-time high this month? Will Taylor Swift attend the Super Bowl? Will a specific political candidate win a key swing state? Users buy “yes” or “no” shares on these outcomes, and when the result comes in, winning bets get paid out in stablecoins like USDC. It’s kind of like a stock market for news — except you're trading on vibes, rumors, data, and gut instinct.

This kind of crowd-powered forecasting isn’t new, but Polymarket’s slick interface, viral markets, and use of blockchain technology made it spread fast. Traders love the speed. Crypto users love the decentralization. And investors love the data. According to Forbes, that’s what attracted Intercontinental Exchange — the parent company of the New York Stock Exchange — to invest $2 billion in the platform in 2025, acquiring up to a 25 percent stake.

Since then, Google Finance and Yahoo Finance have announced they’ll include Polymarket data in search results. PrizePicks, DraftKings, and even the NHL have announced partnerships. A site that once let users bet on when New York would reopen after COVID is now sitting in billion-dollar boardrooms with the people who run global finance.

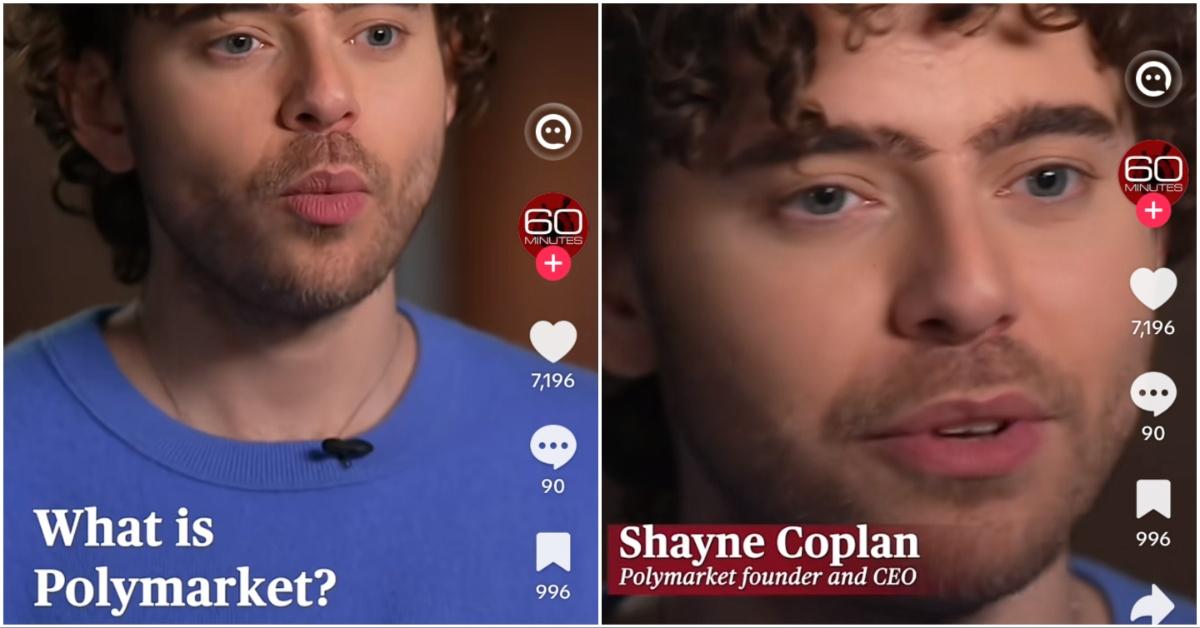

Shayne Coplan's net worth spiked after billionaire investors joined the betting boom.

According to Forbes, Polymarket’s founder, Shayne Coplan, dropped out of NYU in 2017 to work on crypto projects. None of them took off — until Polymarket. He launched it in 2020, partly in response to what he saw as widespread misinformation during the pandemic. His first market let people bet on when New York City would reopen. From there, the idea exploded.

By 2025, Forbes estimated Shayne Coplan’s net worth at $1 billion, thanks to his 11 percent stake in Polymarket and a flood of high-profile backers. The investment round included tech giants like Uber’s Travis Kalanick, Figma’s Dylan Field, and hedge fund veteran Glenn Dubin. Even Red Hot Chili Peppers frontman Anthony Kiedis joined in, after visiting Shayne’s apartment and learning how the platform worked.

Polymarket was temporarily barred from the United States.

That wasn’t the only twist. In 2022, Polymarket got fined $1.4 million by the Commodity Futures Trading Commission (CFTC) and was ordered to block U.S. users. A year later, Shayne’s apartment was raided by the FBI. By mid-2025, after the CFTC dropped its investigation, Polymarket acquired a federally licensed exchange — and was cleared to legally operate in the U.S.

According to Shayne, the shift came after President Trump tapped Caroline Pham to lead the CFTC. “Caroline deserves a lot of credit,” he told Forbes, for unblocking licenses that had been stalled for years. Days after the deal, Polymarket got the green light to launch nationwide.

Prediction markets have been around for years, but they’ve always lived in a legal gray area — somewhere between gambling and investing. Sportsbooks, for example, are taxed and regulated by states. Federally approved prediction markets like Polymarket may be able to skip those rules entirely. That’s part of what makes them so attractive to investors — and so controversial to critics.